The CARES Act intended to incentivize philanthropic giving to nonprofits in 2020. As you or your clients consider an end of year gift, we hope that you will think of ACE Scholarships, especially in light of these new charitable incentives.

Increased deduction for individual cash donations:

Up to 100% of AGI

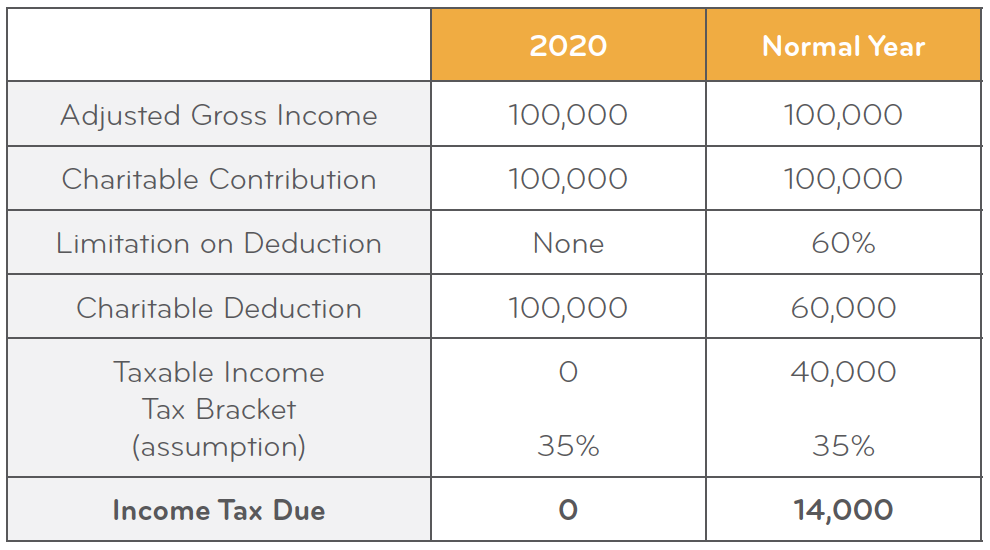

Normally, the deduction a taxpayer can claim for a charitable contribution is limited to 60%.However, in 2020 the limitation has been suspended, and has increased to 100%, meaning any individual filing an itemized return may donate the full amount of their AGI, leaving taxable income at 0.

Example:

Increased deduction for corporate donations: Up to 25%

Much like the individual increase in percentage of the tax deduction for 2020, there has also been an increase in the percentage corporations can deduct for charitable contributions. This increase went from 10% to 25%

$300 “Universal Deduction” for any charitable contribution: Non-itemized tax returns

This incentive adds a universal deduction of up to $300 for taxpayers who do not itemize (i.e. those who take a standard deduction). This new deduction is an above the line adjustment to income that will reduce your AGI and taxable income. It is important to note any donation above the $300 limit(one-time donations, or combined) will not qualify under this deduction incentive, and only applies only to cash gifts given in the year 2020.

This presents a significant opportunity, especially for those who have not yet fulfilled their commitments to ACE. And for those who have given already, you may consider contributing a bit more given this tremendous opportunity.

Download printable version of this page

Please note, the information provided here was accurate at the time of creation, and is intended to be informative and educational, not to be mistaken as legal, accounting, or tax advice. The descriptions and examples provided are for illustrative purposes only and should not be used as the sole example.