Invest in Louisiana’s deserving students, and earn a 95% state income tax credit

At ACE Scholarships, we are changing lives one child at a time by giving low-income parents the freedom to choose the school that is right for their children. You can provide this life-changing opportunity of a quality, K-12 education to disadvantaged children at almost no cost by donating to ACE through Louisiana’s Tuition Donation Credit (TDC).

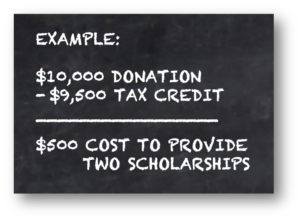

95% of every donation to ACE directly funds a child’s scholarship. You receive a 95% state income tax credit as well as a federal tax deduction on the non-credit portion of your gift—enabling taxpayers to earn a tax benefit of up to 97%. The TDC also saves the state an estimated $1,103 per K-8 student and $552 per high school student. For those inclined to make a positive, powerful impact on our community, the TDC is simply one of the best tax incentives available.

The best part of your investment in ACE scholars? See your IMPACT firsthand on: Check our latest third-party research publications for further detail.

Check our latest third-party research publications for further detail.

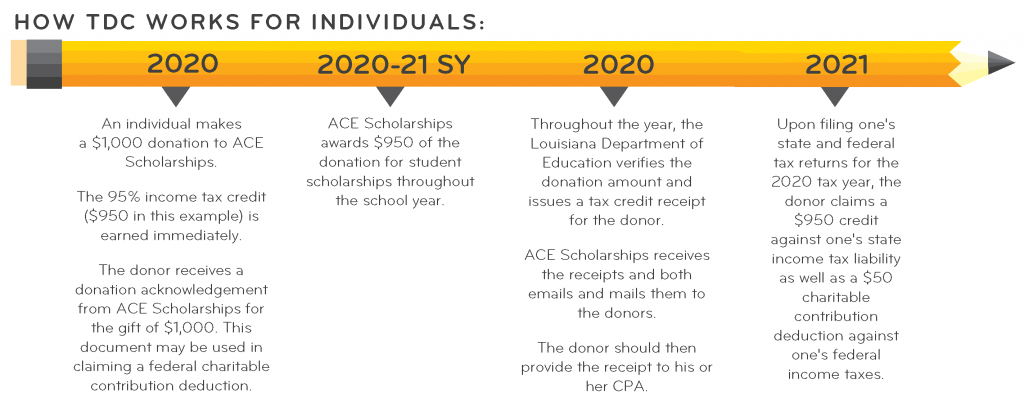

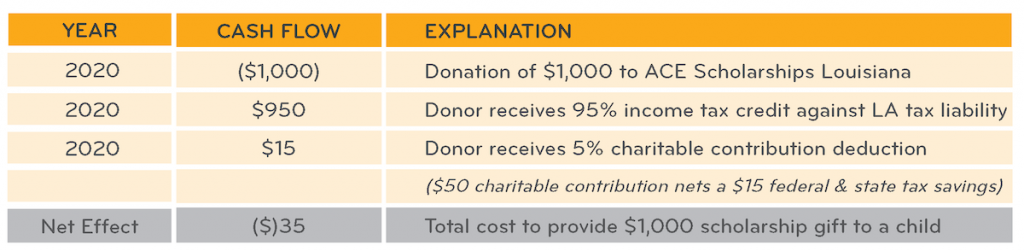

Using the above example, assuming the donor owes $1,000 in state income taxes and has a combined tax rate of 30% (federal rate of 24% and state rate of 6%), the tax implications of a $1,000 tax credit donation to ACE Scholarships are as follows:

ACE LOUISIANA INFO

Our Students, Our Future: Your support will power the future of our Louisiana community.

TDC PROGRAM INFO

Please note: to receive Louisiana’s Tuition Donation Tax Credit (TDC), you will need to complete the Louisiana Tuition Donation Tax Credit (TDC) Pledge Form associated with your ACE donation.