ACE offers an all-in-one service for organizations seeking to participate in the federal tax credit scholarship program. From application processing and digital payments to donor tracking and legal compliance, ACE delivers the infrastructure and expertise to operate at scale.

SERVICES

SGO Partnership Services for Federal Tax Credit Scholarship Programs

End-to-End Administration, Compliance, Digital Wallets, and Donor Management

Interested in ACE services?

Fill out the form below and our team will follow up with you shortly.

STRATEGIC PARTNERS: A WIN-WIN SOLUTION

As organizations evaluate the possibility of forming Scholarship Granting Organizations (SGO)s, they will soon discover the overwhelming administrative and technological challenges of the effort.

- ACE is positioned to meet this need through its proven platform and 26 years of scholarship granting experience—combining experienced people, streamlined processes, and executional proficiency.

- ACE offers a smarter solution—a partnership that leverages its established infrastructure and innovative technology in a mutually beneficial collaboration.

- This means organizations can avoid the operational complexities and startup costs of establishing and operating an SGO while still taking advantage of the federal tax credit opportunity to expand their impact.

Federal Tax Credit For Scholarships – The Opportunity

Dollar-for-dollar tax credit for individuals who donate to an SGO

Thinking of becoming an SGO?

Partnering with ACE is a better solution! ACE offers a strategic alternative for organizations considering becoming a qualifying Scholarship Granting Organization (SGO).

Here’s how we can collaborate to your benefit:

Program Management

ACE administers the federal tax credit for you while ensuring full compliance and operational efficiency.

Donor Facilitation

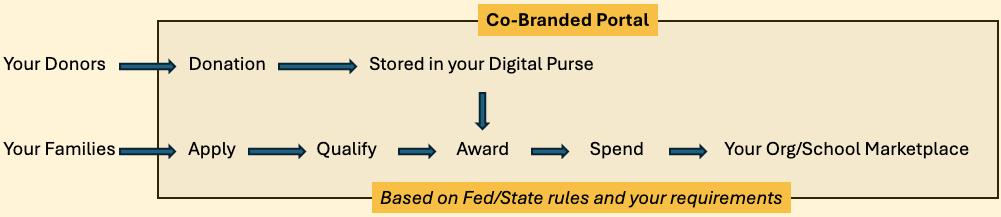

Donors give through a co-branded ACE page, and ACE manages all processing, tracking, and reporting so you can stay focused on impact.

Digital Infrastructure

ACE provides a secure digital wallet, allows you to set amounts and criteria, and gives parents and schools a personalized dashboard with custom applications and eligibility results.

SGO Operational Framework & Strategic Capabilities

1. Financial Management & Transparency

- 10% of total fundraising to cover overhead

- Financial tracking and reporting systems

- Tax documentation to donors in compliance with IRS

- Auditing and financial tracking for families and donors

2. Student & Family Engagement

- Comprehensive application and vetting process

- Digital wallet to award funds

- Marketplace where students can spend awards

- Customer service and support for families and providers

3. Technology to Scale

- Digital, low-touch/high-volume operating model

- Multilingual capabilities

- Data privacy / security compliance, FERPA, HIPAA, SOC 2*

4. Compliance, Governance, Legal

- State / federal management to ensure annual compliance as a qualifying SGO

- Monitor compliance with state and federal laws

5. Communications & Outreach

- Marketing & communications to engage stakeholders

- Support / education to families, donors, and providers

501(C)(3) FORMATION & OPERATIONAL REQUIREMENTS FOR SGOs

Formation Process & Cost

- 501(c)(3) legal filing, IRS approval, and state registration.

- Singular mission focused exclusively on providing K–12 scholarships.

Financial Efficiency & Overhead

- Operate with a maximum of 10% overhead covering operational, marketing, and fundraising costs.

- Ensure 90% of funds raised go directly to scholarships.

Legal & Regulatory Compliance

- Register for charitable solicitation in each state.

- Comply with state and federal laws, including:

- Eligibility requirements such as residency, income, and identity verification.

- Donor restrictions that prevent designating funds for specific students.

- Legal and financial audits to meet IRS and state standards.

Program Operations

- Family qualification and vetting process aligned with legal criteria.

- Award scholarships to eligible families.

- Fund and distribute money to schools.

Staffing & Support

- Provide customer support for families and providers.

- Manage program operations to oversee scholarship processes.

Fundraising and Marketing Strategy

- Dedicated team to cultivate relationships with:

- Donors

- Families

- Partner schools and vendors

ACE Capstone Service

How does ACE Capstone work?

What sets ACE apart?

- Proven model that works

- Integrated platform that allows you to stay mission focused

- ACE can maximize school choice nationwide

- Realize economies of scale

- Spread overhead across a large population of students to serve more families

- At volume, ACE can gain more efficiencies to ensure money goes to students

- All the money you raise will be placed in a digital purse that you control and distribute to schools

Want to see our report card?

ACE is proud to receive Charity Navigator’s highest rating, 4 stars.